Our attorney Matija Urankar appeared in Odmevi, where he answered questions on the amendment to Article 39 of Communicable Diseases Act

20. 04. 2022 Our attorney Matija Urankar, in cooperation with colleagues from Pravna mreža za varstvo demokracije, participated in the drafting of the amendment to Article 39 of Communicable Diseases Act, which has already passed its first reading in the National Assembly of the Republic of Slovenia.

Interview with Katarina Kresal for Delo newspaper

07. 04. 2022 In the interview she spoke about the sanctions against Russian athletes, adopted by individual international sports associations as a result of the Russia's military aggression against Ukraine.

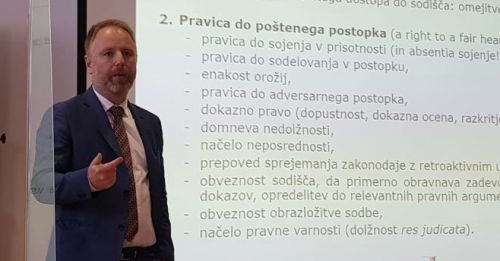

Our colleagues, Uroš Čop, Managing Partner, and Matija Urankar, Senior Associate, gave the traditional lecture, which was attended by students of the Faculty of Law, University of Ljubljana

04. 04. 2022 The topic of the lecture was Article 6 of the European Convention for the Protection of Human Rights and Fundamental Freedoms ("ECHR"), which our colleagues presented to fourth-year students in theory and practice, based on interesting, current cases. The students' response was excellent, and they actively participated in the discussion by asking several questions.

Key factors analysis for successful integration in cross-border transactions

30. 03. 2022 Andersen’s M&A practice in Europe prepared an article, in which it analysed the key factors to achieve a successful integration in cross-border transactions.

Andersen has prepared a newsletter for employers with relevant information on the implementation of EU Whistleblower Directive

28. 03. 2022 The document provides an overview of the implementation of the Directive in 20 European countries, and highlights what will need to be observed by employers and employees in the future, in relation to the protection of whistleblowers.

Matija Urankar, Senior Associate, attended the Elevator Pitch event

24. 03. 2022 After the introductions, we selected five students out of more than 30 participants to do a 1-month paid summer internship.

Partner at our Law Firm Maja Šubic will give a lecture at the Spring Great Conference of Public Procurement

21. 03. 2022 Partner at our Law Firm Maja Šubic will give a lecture at the Spring Great Conference of Public Procurement, which will take place on 11 and 12 April in Portorož.